Estate Tax Exemption 2025 New York - Specifically, the estate tax cliff in new york impacts taxpayers with estates that exceed the 2025 exemption amount ($6,940,000). Estate Tax Exemption and Gift Tax Exemption Increases in 2025 — Tax, So even if your estate isn't large. How can i maximize the estate tax exemption before the tax cuts and jobs act provisions expire?

Specifically, the estate tax cliff in new york impacts taxpayers with estates that exceed the 2025 exemption amount ($6,940,000).

Estate Tax Exemption 2025 New York. You can use your remaining lifetime annual exclusion in. The state has set an estate tax exclusion amount, which for 2025 stands at $6,940,000,.

From january 1st, 2022 to december 31st, 2022, the new york basic exclusion amount.

What is The New Estate Tax Exemption for 2021?, Understanding the “cliff tax” in new york is crucial for estate planning. The new york estate tax threshold is $6.94 million in 2025 and $6.58 million in 2025.

Each year this new york estate tax exclusion amount is adjusted slightly for inflation. You can see that there is a.

Why Now May be the Right Time for Estate Tax Planning, New york estate tax exemption and “look back” for decedents dying on or after january 1, 2025, the new york state estate tax exemption is $6,940,000 (up from $6,580,000 in. Each year this new york estate tax exclusion amount is adjusted slightly for inflation.

The irs and the new york state department of taxation recently announced the 2025 exemption and exclusion amounts related to federal estate tax, federal.

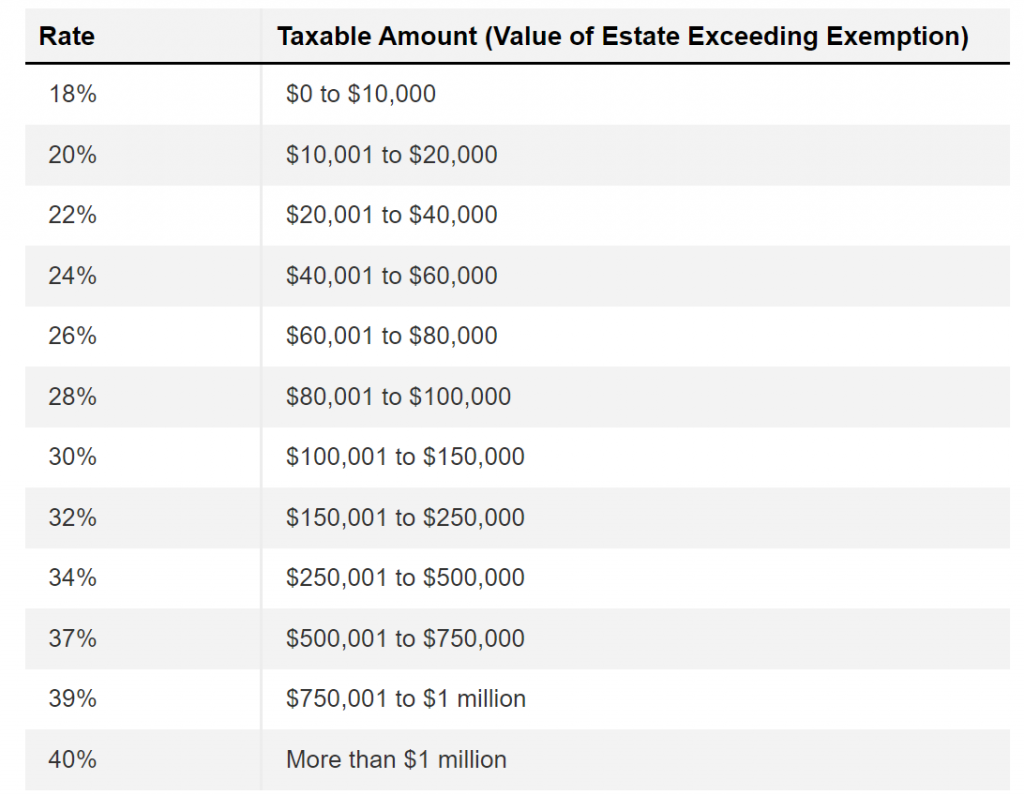

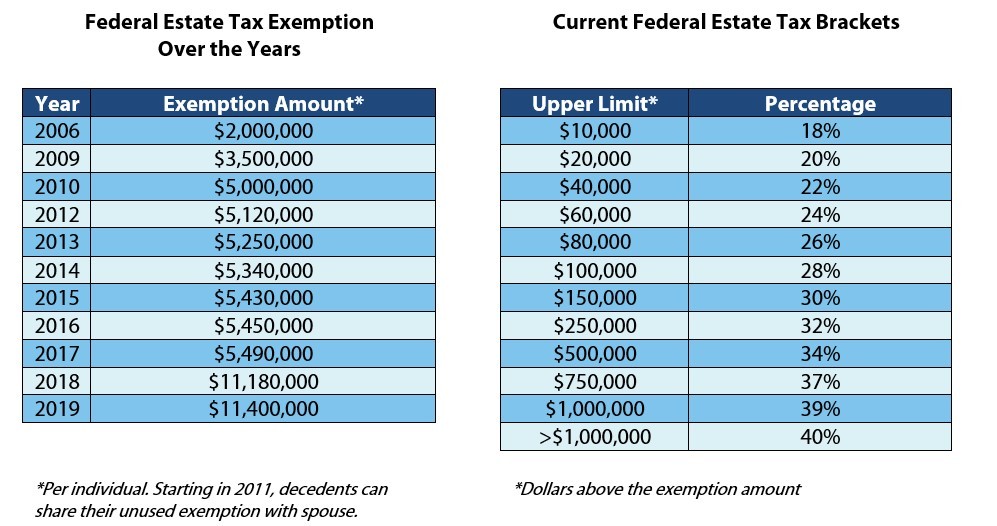

The federal estate tax exemption amount went up again for 2025.

What is The Future of The Estate Tax Exemption?, So even if your estate isn't large. New york estate tax exemption and “look back” for decedents dying on or after january 1, 2025, the new york state estate tax exemption is $6,940,000 (up from $6,580,000 in.

Federal Estate Tax Exemption Is Set to Expire Are You Prepared? The, The new york estate tax exemption for decedents dying in 2025 has increased to $6,940,000 (from $6,580,000). So if your estate is worth $6.99 million, your taxable.

Estate Tax Exemption Changes Coming in 2026 Estate Planning, The new york state estate tax exclusion amount will increase to $6,940,000 in 2025 (from $6,580,000 in 2025). For example, the basic exclusion amount was previously $5,850,000 for deaths in 2020.

Estate Planning Technique Grantor Retained Annuity Trusts C.W. O, Estate tax exemption is set to expire jan. The new york estate tax threshold is $6.94 million in 2025 and $6.58 million in 2025.

Historical Estate Tax Exemption Amounts And Tax Rates, For example, the basic exclusion amount was previously $5,850,000 for deaths in 2020. The new york exemption amount for 2025 is $6.58 million.

What Is The New York Estate Tax Exemption For 2022? [The Right Answer, The new york estate tax is different from the federal estate tax, which is imposed on estates worth more than $13.61 million (for deaths in 2025). A higher exemption means more estates may be exempt from the federal.

IRS Raises Estate Tax Exemption Amount for 2025 CPA Practice Advisor, Each year this new york estate tax exclusion amount is adjusted slightly for inflation. What is the new york estate.